Future-Proof Your Mining: Profitability Predictions & Hosting Strategies

The world of cryptocurrency mining is an ever-evolving arena that demands both strategic foresight and adaptable techniques. As Bitcoin, Ethereum, and Dogecoin continue to captivate the financial landscape, miners are constantly seeking ways to enhance profitability while minimizing operational costs. Understanding market trends, technological advancements, and hosting strategies can significantly influence the success of your mining efforts.

Mining machines, often referred to as mining rigs, are at the heart of cryptocurrency mining operations. These rigs, designed for computational prowess, facilitate the process of validating transactions and adding new blocks to the blockchain. With the rising hash rates and mining difficulty, simply owning a powerful rig isn’t enough; it’s crucial to adopt strategies that lead to sustainable and higher profits. As cryptocurrencies like Bitcoin continue their journey toward global adoption, investing in efficient, high-performance mining hardware becomes imperative.

Hosting services have emerged as a viable option for miners looking to optimize their operations. Instead of housing rigs in suboptimal conditions that often lead to overheating and hardware failure, utilizing professional hosting facilities can mitigate these risks. Such facilities not only provide a controlled environment but also grant access to extensive resources like high-speed internet and optimal power rates. This allows miners to focus on their operations rather than the logistics of maintenance.

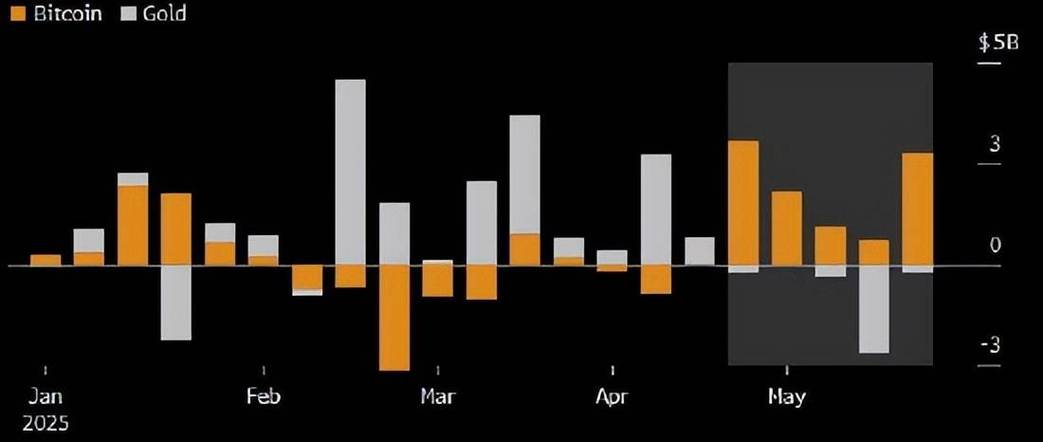

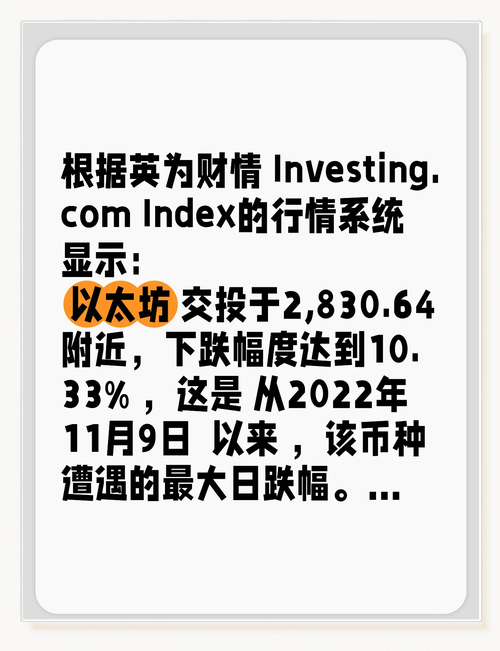

The profitability landscape of cryptocurrencies can fluctuate dramatically. For instance, Bitcoin’s halving events have traditionally led to significant upward price movements, yet they also heighten mining difficulty. Ethereal fluctuations also play a critical role; Ethereum’s impending transition to a proof-of-stake model is a game-changer that could diminish mining profitability for those who rely heavily on traditional mining rigs. To future-proof your investments, diversifying your portfolio by involving multiple cryptocurrencies may yield favorable results.

Moreover, the emergence of altcoins presents miners with unique opportunities. While Bitcoin and Ethereum dominate the market, currencies like Dogecoin and others can provide substantial returns if mined under the right conditions. These altcoins often have lower mining difficulties, and participating in their networks can yield quicker returns on investments. Thus, an informed approach that combines both established and emerging cryptocurrencies can maximize potential profits.

It is also crucial to stay informed about different exchanges where miners can trade their cryptocurrencies. Exchanges often experience fluctuations in fees, security features, and liquidity, making it essential for miners to choose platforms that provide the best trade-off between these factors. Timely trading can enhance profitability, especially when leveraging market trends and engaging in tactical buying and selling.

As miners contemplate their strategies, they should also consider the implications of energy consumption. The environmental impact of cryptocurrency mining has gained scrutiny, prompting many miners to investigate renewable energy solutions. Adopting green energy not only aligns with global sustainability efforts but can also significantly reduce electricity costs in the long run. Combining financial acumen with environmental responsibility can position miners as leaders in an industry that is at times viewed skeptically.

In conclusion, successfully navigating the realm of cryptocurrency mining requires a multifaceted approach. Understanding the dynamics of various coins, leveraging optimal hosting solutions, and staying ahead of market trends are pivotal in maximizing profitability. The future of mining appears bright, and those who prepare adequately, adopting innovative strategies and technologies, will likely reap the rewards in this digital gold rush.