Maximize Your Hashrate: Nigerian Mining Hardware Guide

Nigeria, a land brimming with entrepreneurial spirit and a burgeoning tech scene, is increasingly becoming a hotspot for cryptocurrency adoption. While direct Bitcoin purchases grab headlines, a quieter revolution is underway: cryptocurrency mining. The potential for profit, coupled with a growing understanding of blockchain technology, is driving interest in mining hardware across the nation. This guide delves into navigating the complexities of acquiring and optimizing mining rigs in Nigeria, ensuring you maximize your hashrate and navigate the evolving landscape of digital currency.

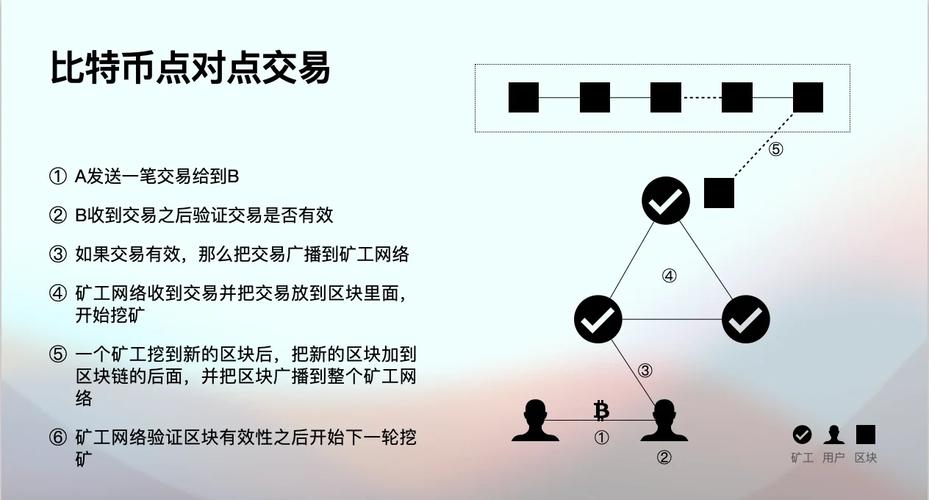

Venturing into the world of cryptocurrency mining requires a foundational understanding of the core components. It’s not simply about acquiring a machine; it’s about understanding the algorithm being mined, the power consumption of the rig, and the overall efficiency of the setup. Bitcoin, for instance, relies on the SHA-256 algorithm, necessitating specialized Application-Specific Integrated Circuits (ASICs). Ethereum, while historically reliant on Proof-of-Work (PoW), has transitioned to Proof-of-Stake (PoS), diminishing the need for high-powered mining hardware for ETH itself, but opening doors for mining other Ethash algorithm-based coins. Dogecoin, with its Scrypt algorithm, presents another set of considerations. Each cryptocurrency demands specific hardware optimized for its unique computational demands.

The Nigerian market presents unique challenges and opportunities when it comes to acquiring mining hardware. Importing directly from manufacturers, often based in China, is a common route. However, this path is fraught with potential hurdles: import duties, shipping costs, and the ever-present risk of scams. Thorough due diligence is paramount. Reputable suppliers should offer warranties, provide clear product specifications, and ideally, have a physical presence or established reputation within the cryptocurrency community. Locally sourcing hardware can mitigate some of these risks, although availability and pricing might be less competitive. Engaging with Nigerian cryptocurrency forums and online communities can provide invaluable insights into reliable vendors and common pitfalls.

Beyond the initial purchase, optimizing your mining rig is crucial for maximizing profitability. Cooling is a critical factor, especially in Nigeria’s often-hot climate. Overheating can significantly reduce the lifespan of your hardware and diminish its performance. Investing in efficient cooling solutions, such as immersion cooling or well-ventilated mining containers, is a worthwhile investment. Power consumption is another key consideration. Securing a reliable and affordable power source is paramount. Exploring alternative energy sources, such as solar power, can reduce operational costs and promote environmental sustainability. Regular maintenance, including cleaning dust and monitoring performance metrics, is essential for ensuring the long-term viability of your mining operation.

For those lacking the technical expertise or resources to manage their own mining infrastructure, hosting services present a viable alternative. Mining farms offer a secure and optimized environment for housing and maintaining your mining rigs. These facilities typically provide reliable power, efficient cooling, and dedicated technical support. While hosting incurs recurring fees, it can eliminate the complexities of managing your own mining operation and potentially increase profitability. However, selecting a reputable and reliable hosting provider is crucial. Research their track record, assess their security measures, and understand their pricing structure before entrusting them with your valuable hardware.

The regulatory landscape surrounding cryptocurrency mining in Nigeria is still evolving. While cryptocurrency trading is generally permissible, the Central Bank of Nigeria (CBN) has issued directives restricting financial institutions from facilitating cryptocurrency transactions. This regulatory uncertainty adds a layer of complexity to the mining landscape. Staying informed about the latest regulatory developments and ensuring compliance with applicable laws is crucial for mitigating potential risks. Engaging with legal experts specializing in cryptocurrency regulations can provide valuable guidance.

Ultimately, maximizing your hashrate and achieving profitability in the Nigerian cryptocurrency mining landscape requires a combination of careful planning, thorough research, and diligent execution. Understanding the nuances of different cryptocurrencies, sourcing reliable hardware, optimizing your mining rig, and navigating the regulatory landscape are all essential components of a successful mining operation. By embracing a strategic and informed approach, Nigerian entrepreneurs can unlock the potential of cryptocurrency mining and contribute to the growth of the nation’s digital economy.

Diversifying your mining portfolio can also be a strategic move. While Bitcoin remains the dominant cryptocurrency, exploring alternative coins with lower hash rates and potentially higher profitability can be beneficial. Researching emerging cryptocurrencies and understanding their underlying technology can uncover lucrative mining opportunities. However, it’s important to approach alternative coins with caution, as they often carry higher risks than established cryptocurrencies like Bitcoin and Ethereum. Conducting thorough due diligence and understanding the potential rewards and risks is essential for making informed decisions.

Finally, continuous learning and adaptation are crucial for navigating the ever-evolving cryptocurrency mining landscape. Staying abreast of the latest technological advancements, regulatory developments, and market trends is essential for maintaining a competitive edge. Engaging with online communities, attending industry events, and pursuing ongoing education can provide valuable insights and help you adapt to the changing demands of the digital currency market. The future of cryptocurrency mining in Nigeria is bright, but success requires a commitment to continuous learning and a willingness to adapt to the evolving landscape.